December 6, 2023

Fintech app development solutions are revolutionizing the financial services industry by offering innovative digital solutions for banking, investing, lending, and more. As fintech app usage grows exponentially, it's essential to build secure, scalable apps that can handle spikes in traffic and protect sensitive user data. This guide will explore key considerations for developing robust fintech app development services equipped for the modern digital landscape.

.png)

The demand for fintech apps is booming as financial services rapidly go digital. User expectations are high for fast, convenient access to manage finances through mobile apps. Key capabilities like processing payments, trading stocks, lending money, and more are required to stay competitive.

However, with impressive innovation comes great responsibility around security and scalability.

As fintech app development solutions handle highly sensitive user data and financial transactions, watertight protections are a prerequisite. Additionally, seamless expandability is fundamental to exponential adoption growth in the sector.

By implementing mindful processes to intentionally engineer security, scalability, and core functionality from initial architecture decisions through launch and beyond, any fintech app development company can gain a sustaining edge to lead disruption in this critical domain.

The foundation for designing a successful fintech app is deeply understanding your target customers and their unmet needs. Then, define the key features and functionality that will become their go-to solution, hook users in quickly, and establish loyalty over time.

For example, envision building a next-generation crypto exchange app.

Capabilities could encompass: highly intuitive desktop and mobile dashboards displaying balances and market data, seamless connectivity across users’ existing crypto wallets and exchanges, efficient trading capabilities across top tokens, staking rewards programs for certain assets, and more. Document essential user flows to optimize early on, like user signup/verification, initial crypto deposits, placing of first trades, and withdrawals.

Getting crystal clear on your core features and the step-by-step processes that bring them to life sets the direction for planning architecture and fintech app development ahead.

Careful selection of programming languages, frameworks, and cloud infrastructure is imperative to deliver peak fintech app speed, security, and efficiency as usage scales up.

Key considerations span:

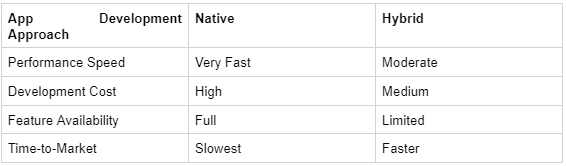

Native, Hybrid, or Web App Model: Native apps enable maximum speeds by tailoring development specifically for the target platform like iOS or Android.

However, building platforms individually substantially increases costs. The hybrid approach offers a middle ground - fintech apps are built using cross-platform web programming languages and then packaged into platform-specific wrappers. Performance can lag native, but faster iteration helps contain costs. Web apps provide the fastest spin-up using standard web programming languages, but limit more advanced features found in native and hybrid approaches.

Critical Choices for Frontend and Backend Development: Leading backend languages like Java, Python, and Ruby enable complex server-side logic to handle analysis, transactions, connections with external systems, and more. Meanwhile, JavaScript frameworks provide intuitive and responsive user interfaces on the front end, with React Native emerging as a top choice for fintech app development.

Enabling Security, Storage, and Compute Scale: Cloud platforms like AWS, Azure, and Google Cloud provide a robust infrastructure for fintech apps, including security controls, storage capacity increases, and expanding server resources to meet demand spikes.

Making informed choices here based on app requirements, developer expertise, and best community support pays dividends in better future-proofing.

Enabling flexible scaling is imperative for fintech apps to support spikes in adoption without performance lags or exorbitant infrastructure costs. Carefully optimizing architecture for efficient resource utilization unlocks growth in a cost-effective manner. This allows even startups and smaller companies with limited budgets to plan for demand spikes.

Strategies include:

Spinning up additional compute servers through cloud platforms enables seamlessly expanding capacity as needed. Right-sized increments balance performance and costs as daily active users or transactions grow over time. Prioritize automating server additions for optimized spending.

Scale vertically by upgrading server sizes and computing power in a targeted manner during identified usage surges, rather than consistently over-provisioning. Combining occasional vertical expansion with horizontal scale effects enables adaptable capability increases within budget constraints.

As fintech data storage needs increase, database sharding strategically segments elements across multiple databases to reduce individual server loads. This allows smaller servers to handle pieces of larger data pools still enabling fast parallel access.

Balancing application workloads across available compute resources maximizes usage of provisioned servers before needing to add additional capacity. Smart load balancing improves speed and saves costs.

Breaking fintech apps into discrete microservices makes updating or scaling easier by isolating key functions like user authentication or transactions into independent deployable units. This way, capacity can be added just for the specific services requiring more resources.

Architecting for efficient scaling enables fintech apps to grow users, data and capabilities without proportional infrastructure cost increases. Planning processes and technical approaches purposefully to maximize resource utilization saves startups money over the long-term.

For fintech app development solutions entrusted with highly sensitive user information and managing financial transactions, security is utterly paramount with immense liability for breach failures.

Recommended industry standards include:

Attaining the ISO 27001 standard demonstrates comprehensive evaluations spanning risk assessments, vulnerability testing, access controls, encryption protocols and security policy enforcement meet the highest institutional benchmarks.

If processing credit card payments, compliance to PCI Data Security Standards validating protections for storing, transmitting and handling sensitive cardholder information provides a vital certification to share with users.

Validation by SOC 2 attests security, availability, processing integrity, and confidentiality controls adhere to strict audit standards providing transparency to users on data handling.

Leaders deeply integrate stringent protections spanning:

Encrypt data in transit and at rest throughout infrastructure, only granting access based on strict key management permissions. Make encryption mandatory, not optional to prevent data exposure gaps.

Tokenize payment credentials and account numbers to remove visibility of underlying values, reducing exploit risks by substituting symbols only meaningful temporarily or internally.

Rigorously validate and sanitize all user input on servers before execution to guard against script injections or unauthorized parameter tampering among top Open Web Application Security Project risks.

Provide an additional verification factor like biometrics or one-time-passcode sent to a mobile device during login to establish user identity certainty beyond a password.

This multi-layered approach combining encryption, tokenization, validation and authentication compounds security strength.

With robust infrastructure established, the app experience bringing capabilities to life is paramount. Smooth flows, responsive designs, and convenience drive fintech app adoption over competing options.

Core UX components include:

Enable fast new account creation using clear data entry, thoughtful identity checks to reduce fraud, and seamless confirmation eliminating Extra steps. Each field and tap should build confidence.

Present analysis like cash flow, spending trends and investment performance visually to enable personal understanding and ownership for users. Ensure critical actions are prominently placed for their needs.

Users expect instant ability to pay bills, deposit funds, transfer to friends and more. Meet their standards through clear status visibility, presumed defaults, and extremely reliable connections with banks enhancing perceptions of security and integrity.

Seek user input on frustrations and desired improvements routinely. Fix the fixable immediately through rapid iteration. Double down on engagement drivers and reimagine ineffective elements. Matching market needs outpaces the competition.

The most elegantly engineered system counts for little if users struggle to access its core jobs to be done intuitively. Center simplicity, visibility, and responsiveness in-app experiences to enable fintech app development ventures to flourish.

The fintech app development sector requires deep compliance rigor to meet extensive regulations protecting consumers around data privacy, financial disclosures, cybersecurity standards, anti-money laundering laws, and much more. Keeping compliant from product inception helps fintech innovators lead markets responsibly and minimize legal blowback.

Core elements include:

Accomplish rigorous licensing processes like SEC qualifications, state money transmitter licenses, and international licenses allowing operations in target jurisdictions. Legal experts help navigate complex, dynamic regulations across hundreds of geographic markets.

Incorporate mandatory identity verification, background checks, usage monitoring, and activity flagging to enable fraud and money laundering protections as well as tax compliance.

Prominently display Terms of Service and Privacy Policies detailing data handling practices and user rights. Obtain explicit consent frequently.

Continuous legal input into design decisions and compliance program maintenance sustains long-term viability.

Meticulous fintech app upkeep after launch prevents crises and fuels growth through three key mechanisms:

Carving out dedicated resources to listen to your market and maintain excellence cements app positioning over the long haul.

An exceptional fintech app deserves an exceptional unveiling. Strategically plan launch activities generating excitement and catalyzing viral adoption, including:

Design appealing visual identities, craft press release content spotlighting your competitive differentiator, produce explanatory videos walking through app capabilities to convey its value powerfully.

Identify and build relationships with relevant journalists, industry analysts, consumer advocates, and social media personalities to tell your unique story. Their voices ignite awareness.

Even before launch, lay the foundations for referral programs, allowing new users to invite trusted contacts and secure rewards upon signups. Embedding structured growth through peer sharing creates network effects over time.

Welcome users excitedly, explain initial steps clearly, enable responsive assistance, and track usage data guiding refinements that directly improve retention via dedicated onboarding processes.

Continually listening, improving, and strategically expanding value propels flourishing fintech ventures over the long run.

While developing leading fintech apps involves complex considerations around scale, security, and launch success, immense market opportunities propel persistence through the challenges. Adoption continues expanding exponentially as financial services digitize globally. However, intensifying competition simultaneously raises the stakes for building differentiated offerings matching user speed and convenience expectations in the palm of their hands.

The future outlook remains highly optimistic, with the fintech app development sphere projected to triple in market value exceeding $305 billion by 2025. Realizing this monumental potential involves balancing user centrality with engineering excellence across the comprehensive disciplines detailed.

Companies taking an intentional, long-term approach to architecting infrastructure and experiences poised for disruption will claim market leadership for years ahead.

Global fintech development powerhouse Consagous Technologies, a leading fintech app development company, has over a decade of experience crafting category-leading mobile financial applications designed for security, scale, and seamless user experiences.

Our end-to-end fintech app development solution build capabilities encompass user experience design, cloud infrastructure optimization, microservices development, extensive test automation, and managed application hosting.

Contact our fintech app developers today through consagous.co to schedule a consultation outlining how our custom fintech app development services uniquely position your offerings for market dominance.